Life and pension insurance are insurance products with comparatively high commissions for the intermediary. For example, the agent of a pension insurance of € 200 per month with a term of 37 years receives a one-off commission of up to € 4,500 and an inventory commission of a further € 6,000 spread over the term of the contract.

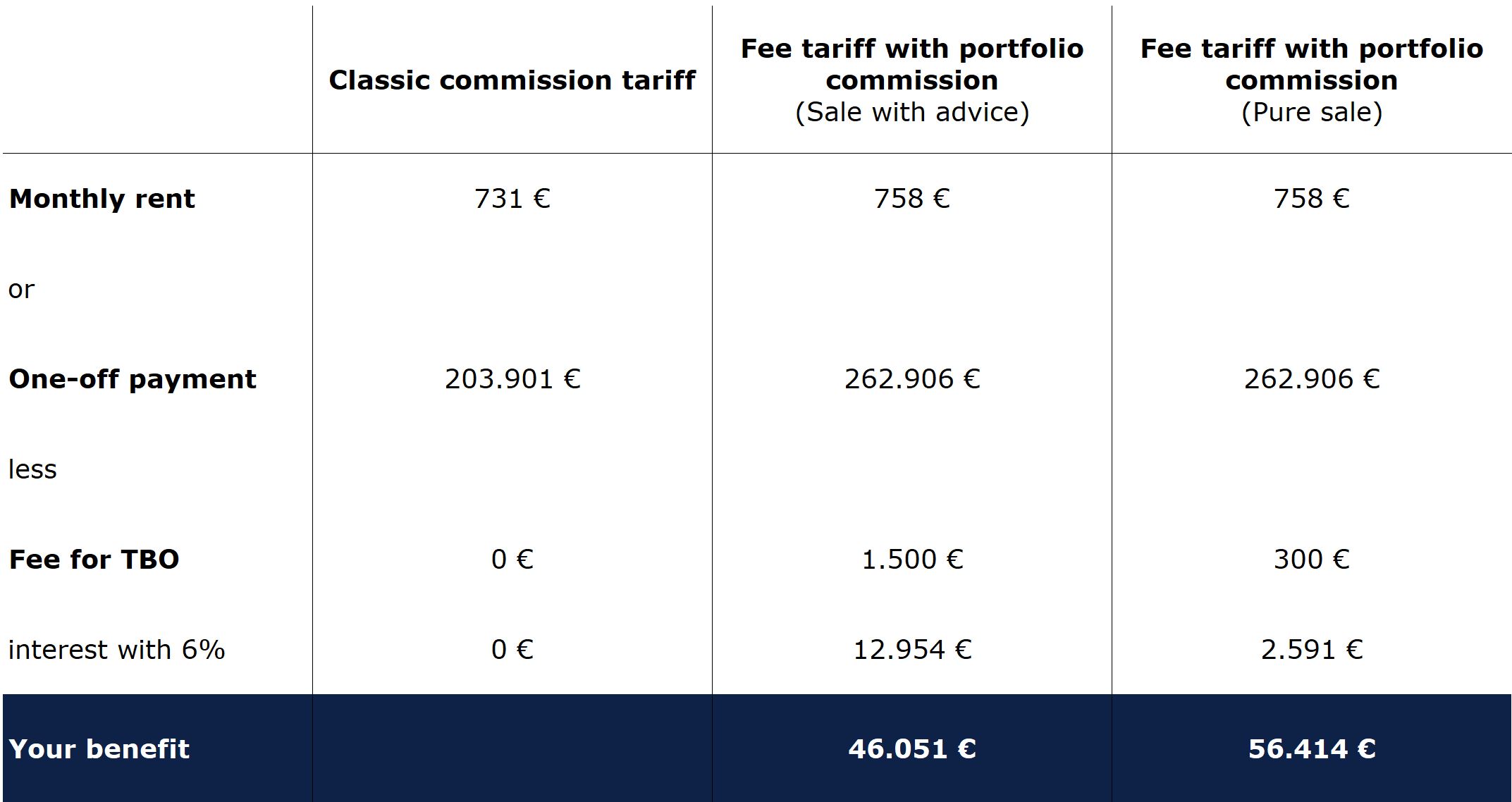

You pay these commissions with your contributions. Your process performance is not only reduced by the amount of the commission. Since a large part of the commission accrues in the early years, you miss the so important interest effect, so that your loss is a multiple of the commission amount.

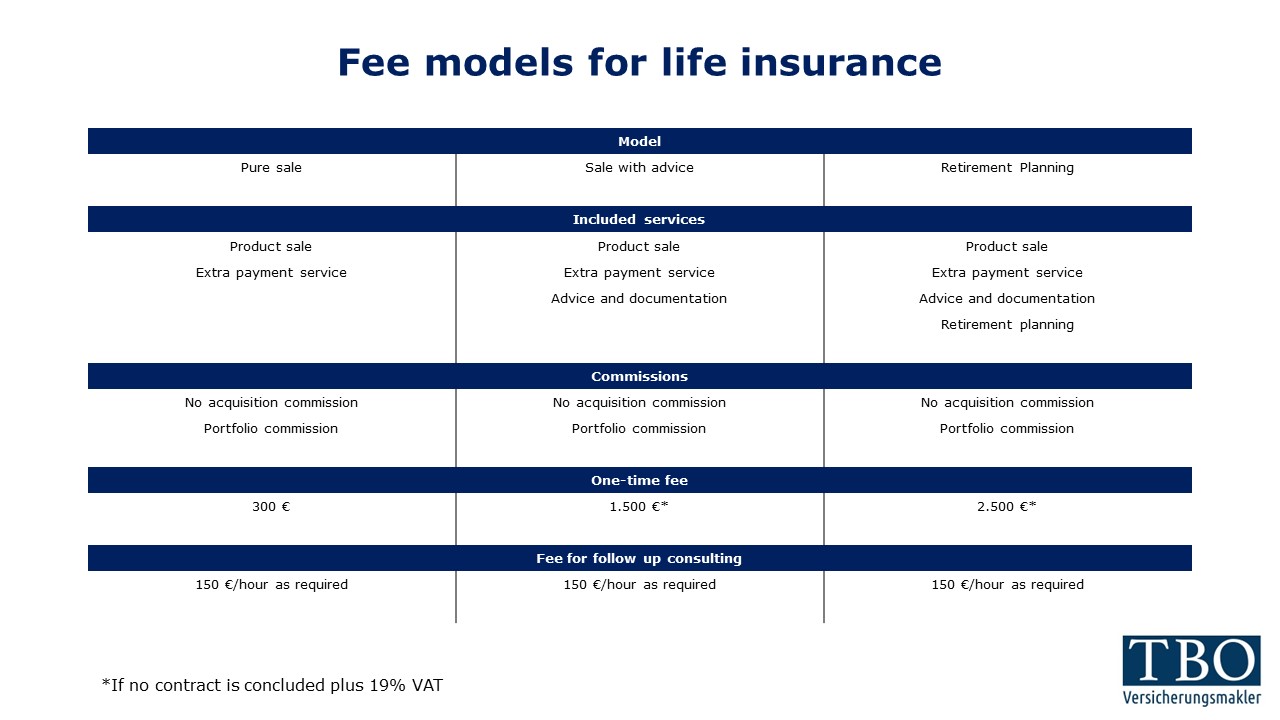

We do not find this system fair. The commission amount in no way reflects the actual effort of the consultant. In our view, the often high commission is one of the main reasons that pension insurance companies have such a bad reputation. However, because the statutory pension is unlikely to be sufficient to live a decent life in old age, additional old-age provision cannot be dispensed with. That is why we offer pension insurance on a fee basis.